Lean and Secure Decentralized Delivery-versus-Payment (DvP) for Securities Settlement

Introduction

As digital assets and distributed ledger technologies continue to gain momentum, it is crucial to explore how Central Bank Digital Currencies (CBDC) can enhance the functionality, safety, and efficiency of securities settlements, particularly the Delivery-versus-Payment (DvP) process. Central banks are preparing for the incorporation of CBDC solutions into the settlement process of digital assets – for example the Exploratory Phase of the Eurosystem. This necessitates the establishment of solid functional bridges between CBDC and Market DLT Platforms to ensure interoperability and seamless transactions. In this article, we will discuss the concept of decentralized Delivery-versus-Paymentand its potential benefits.

Delivery-versus-Payment (DvP)

Delivery-versus-Payment (DvP) describes a financial transaction settlement method that ensures the simultaneous exchange of securities and cash between two parties. The primary goal of DvP is to mitigate the risks associated with the delivery of securities and the payment for those securities. In a DvP transaction, the buyer’s payment is only made once the seller has successfully delivered the agreed-upon securities. This synchronous exchange helps reduce counterparty risk, as it ensures that both parties fulfil their obligations simultaneously. If one party fails to meet its part of the transaction, the other party is protected from potential losses. Here, we face the problem how secure DvP can be realized across two otherwise independent DLTs, e.g. one for the assets and one for the payments.

Decentralized DvP

The Hash-Link Concept has emerged as a favourable solution to address the DvP problem for securities settlements on DLT platforms. This concept enables an asset-versus-cash transaction across two infrastructures and has gained prominence through publications like „Integrating DLTs with market infrastructures“ by Banca d’Italia (2022), please click here for a summary. Several implementation variants exist. A prominent variant requires a so-called “time-lock” that reserves the asset or payment for a certain time, to ensure completion. To overcome associated technical risks Banca d’Italia proposes an API-based concept that introduces a DvP-Oracle, responsible for generating and managing keys for settlement success or failure. This approach allows the removal of the time-lock mechanism. However, the DvP-Oracle needs to generate and hold keys, requiring off-chain storage that may be vulnerable to attacks.

No public functional standard

To solve cross-chain Delivery-versus-Payment (DvP) challenges, no public final functional standard has yet emerged, particularly in the German market. However, solutions based on third-party intermediary APIs have been proposed to bridge the gap between asset and payment networks. While these solutions offer potential benefits, they also introduce new technical risks, additional costs, and may require additional authorization to book on parties‘ central bank accounts.

From Smart Derivative Contract to Decentralized DvP

This has motivated the development of a decentralized and lean DvP concept, building on the Smart Derivative Contract (SDC) for OTC derivatives settlements. The SDC concept has successfully solved the DvP problem for derivatives on a single blockchain infrastructure, ensuring the delivery of market value and settlement in cash. However, the settlement of securities presents similar challenges but with the added complexity of processing across two infrastructures and the possible need for synchronization or a time-lock mechanism.

To address these challenges, we propose a lean functional pattern for DvP without an extra intermediary. In this concept, the organizational setup involves a payment operator or other service provider that offers functionality to decrypt a document with a secret key depending on the success of the payment request. This service does not incorporate the knowledge or storage of specific transaction details.

Each trading party generates a “document” that serve as key for the other party to claim the asset from the asset chain. However, there documents are not published. Instead, the two parties encrypt the documents with a public key from the payment chain operator and the exchange the encrypted document only. The asset chain also only knows the encrypted documents. The payment chain operator then offers the single service to decrypt the respective documents upon successful or failed payment. Showing the decrypted document to the asset chain then unlocks the delivery.

Implementation against a Payment Chain

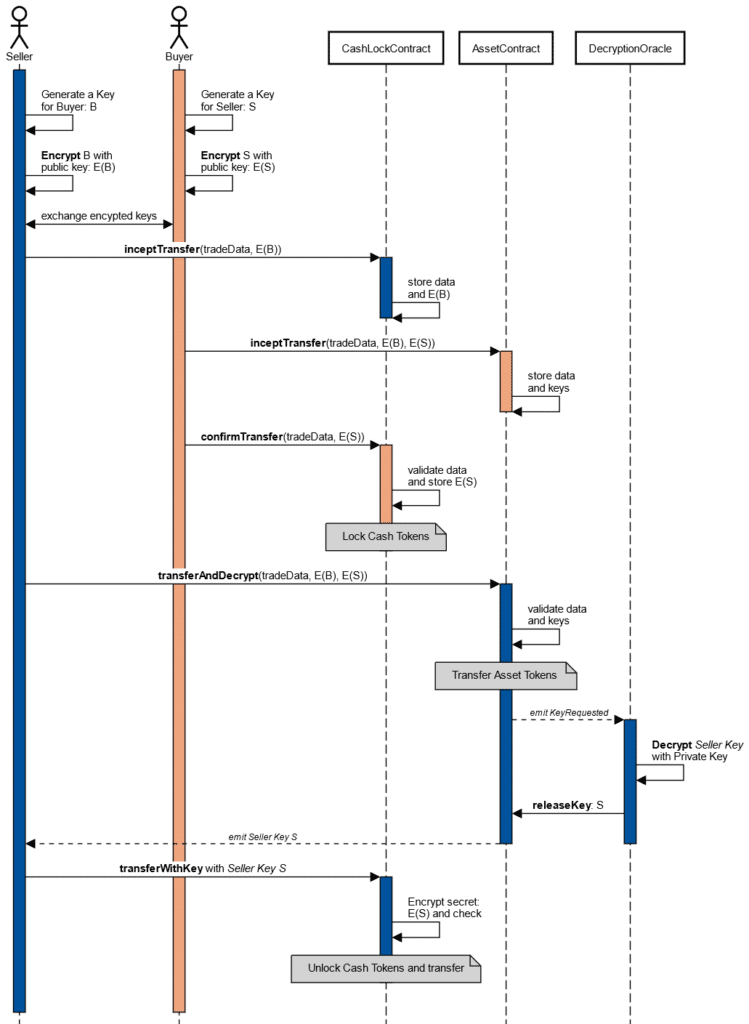

The following Sequence Diagram shows the successful process flow of a full decentralized securities settlement transaction without Time-Lock Feature.

Some Remarks:

- Seller and Buyer generate an encrypted Secret by using the public key of the Decryption Oracle

- Cash instead of Asset gets locked and functionality on Asset Chain is kept very lean: Depending on the Transfer-Success either the encrypted key of the seller or the buyer is sent to the Decryption Oracle

- No Time-Lock Scheme is required: If Seller does not transfer the asset (by not calling transferAndDecrypt), the buyer can cancel the DvP-Transaction by calling a cancellation-function which is not depicted

- The interaction with the Decryption Oracle is lean and does not involve any transaction details

- The Decryption Oracle does not need to store any data. It only offers functionality to decrypt a provided secret and stores the dercypted key in the asset contract.

- Release of the decrypted key is public to everyone as the CashLockContract „knows“ who is allowed to use it to release the key

- Installing an Encryption-Algorithm on-chain might be to costly. This can be circumvented by just storing the hashes of the keys H(S) and H(B) in the CashLockContract. Encrypted keys E(B) and E(S) will still be handed over to the Asset Contract, where one of each gets decrypted. An additional service is required to let parties check whether a provided encrypted key can be used to reproduce its hash correctly: f(E(K)) = H(K). Note that for this function the key itself will not get published.

Realization Perspective and EIP 7573

This concept allows for decentralized implementation with one contract on the asset chain and one contract on the payment chain. It eliminates the need for the payment operator (DvP Oracle) to store transaction details regarding the asset transfer, as the only functionality required is the decryption of provided encrypted documents. Furthermore, this concept enables direct payment execution on the Trigger Chain while securing DvP in a decentralized manner.

To emphasize, the advantage of this approach is the stateless and loose coupling of the two DLTs.

From a realization perspective, the concept awaits functional interface approval under EIP-7573. From an infrastructural view Bundesbank Trigger Chain provides an opportunity to implement this DvP concept against the Payment Instruction Contract as depicted above. Additionally, other market infrastructure providers can take on the role of a stateless „DvP Operator“, offering encryption functionality as a new service.

Summary

The presented concept of decentralized DvP offers an alternative approach to the existing ones. It allows parties to execute payments directly on an appropriate Payment Chain (e. g. Bundesbank Trigger Chain) while maintaining a decentralized, lean and secure DvP process. By leveraging encrypted documents and a decentralized organizational setup, this concept offers a robust solution that minimizes reliance on intermediaries.

In conclusion, decentralized Delivery-versus-Payment (DvP) for securities settlements offers a potential solution to enhance the functionality, safety, and efficiency of transactions in the digital asset space. By leveraging the Hash-Link Concept eliminating the Time-Lock feature, our lean functional pattern addresses the complexities of cross-chain DvP while eliminating the need for an extra intermediary.

The advantages of the proposed concept include the ability to execute payments directly on the Payment Chain (e. g. Bundesbank Trigger Chain), leveraging existing cash-locking mechanisms provided by public solution providers. Furthermore, the decentralized nature of this approach reduces reliance on centralized entities and opens opportunities for various market infrastructure providers to contribute as stateless DvP operators.

However, additional research, collaboration, and validation are necessary to refine and optimize this concept. Ongoing efforts to develop robust standards and frameworks for cross-chain DvP are crucial. Rigorous testing and evaluation will ensure the viability and security of this concept in real-world scenarios.

Overall, the concept of decentralized DvP represents an exciting development for the future of digital assets and Central Bank Digital Currencies (CBDC). Through continued exploration and collaboration, the financial industry can work towards a more efficient and inclusive ecosystem that benefits all stakeholders involved in securities settlements.

Disclaimer: The opinions and statements expressed in this article are those of the author and do not necessarily represent the views of the company or organization.

Diese Themen interessieren uns

Lean and Secure Decentralized Delivery-versus-Payment (DvP) for Securities Settlement

22. Dezember 2023

FinTech Innovationen in Asien – Ein Blick auf das FinTech Festival in Singapur

3. November 2023