A promising Publication on token-based Central Bank Money

In a recent publication Banque de France summarizes its Wholesale Central Bank Digital Currency (wCBDC) experiments using Distributed Ledger Technology (DLT). The experiments have shown that a wCBDC can provide added value to financial market infrastructures in terms of improved and safer settlement procedures for a wide range of digital and conventional financial assets and their related processes.

Importance of digital Central Bank Money within DLT Systems

The experiments have shown how wholesale financial transactions recorded on DLT platforms could be settled by the use of digital central bank money. The report emphasizes the importance of prioritizing and strengthening the use of central bank money within evolving DLT ecosystems to ensure interoperability and financial market stability. The anchoring function of central bank money as the most riskless settlement asset should be preserved, when it will be provided also in a digital form.

Integration Aspects and Role of a Central Bank

The report summarizes operational feasibility and implementation issues of three wholesale CBDC models. These models address different implementation aspects and offer different capabilities compared to conventional systems to offer them for rather complementary use. Banque de France believes that multiple wholesale DLTs could coexist globally and emphasize the need to design them with interoperability in mind. Central banks should stay technologically neural while on the other hand participate actively in the creation and adoption of common digital standards.

Added Value of Tokenized Central Bank Money

The study shows that a tokenized form of a CBDC will enable atomic settlement for a range of new digital financial assets that currently cannot be settled frictionless using conventional payment infrastructures like TARGET. Beyond that standardized digital forms of central bank money can also play an important role to remove frictions for conventional trade and post-trade processes. The combination of a tokenised wCBDC and well-designed digital post-trade standards from the industry, such as a recent proposal for Smart Derivatives: ERC-6123, can enhance comprehensive capture of Settlement and Counterparty Credit Risk in Securities and OTC Derivatives Markets. Therefore new technologies could also serve to address the demands of current regulatory requirements.

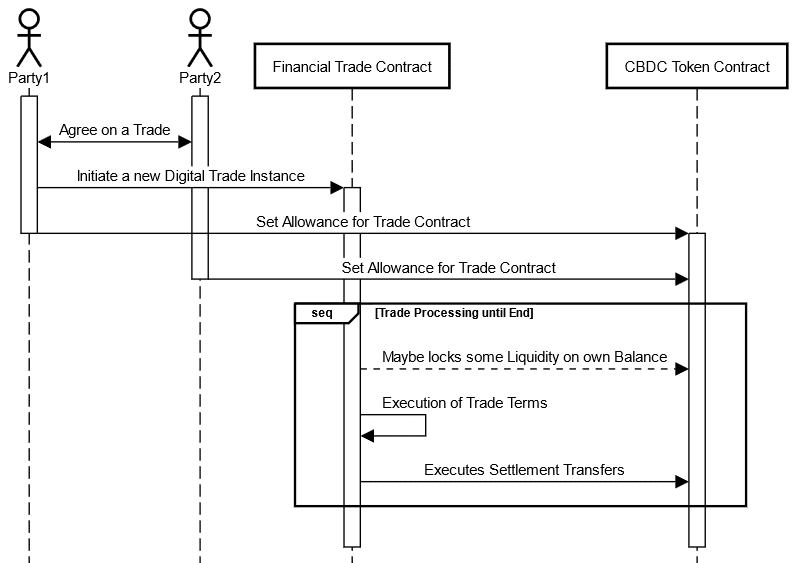

How future contract-based Interactions against a CBDC Token may look like

The following sequence diagram depicts on a generic level how financial based smart contracts could interact against a CDBC Token Contract.

This generic sequence can be applied to conventional or digital Securities as well as OTC-Derivative based Transactions.

Concluding Remarks

It seems very promising that a central bank has thoroughly explored and proven that digital central bank money offers added value in settling digital financial assets and conventional trade activities. Emphasizing interoperability and active contribution to evolving digital standards by Central Banks are crucial for sustainable growth the accelerated adoption of these new technologies which may provide added value in terms of risk reduction in financial markets. Click here for more details regarding the conducted experiments.

Disclaimer: The opinions and statements expressed in this article are those of the author and do not necessarily represent the views of the company or organization.

Diese Themen interessieren uns

Lean and Secure Decentralized Delivery-versus-Payment (DvP) for Securities Settlement

22. Dezember 2023

FinTech Innovationen in Asien – Ein Blick auf das FinTech Festival in Singapur

3. November 2023