Exploring „Purpose Bound Money“

By the end of June 2023 Monetary Authority of Singapore has published a technical paper on so-called Purpose Bound Money (PBM). PBM is supposed to serve as a common protocol which can direct money towards a specific purpose without requiring the money itself to be programmed. The paper also highlights possibilities of how digital money can be designed to fulfill purpose-related objectives without modifying its native properties. This article provides a rough overview on the concept.

What it is about

Digital assets refer to the digital representation of value, such as the ownership of financial assets or real economy assets. Central bank digital currencies (CBDCs), tokenised bank liabilities and potentially well-regulated stable coins, together with a set of well-designed smart contracts, could serve as the medium of exchange for this new digital asset based ecosystem.

The most prominent benefit of digital money is its ability to support programmability features. On the other hand one need to ensure that programmability does not come at the expense of digital money’s ability to serve as a medium of exchange.

PBMs basically puts a function layer around base money units, enabling the bounding or unbounding related to special conditions. So after a specific purpose is met PBM becomes unbounded again, comparable to a digital voucher, offering the receiver unrestricted use afterwards.

How it works

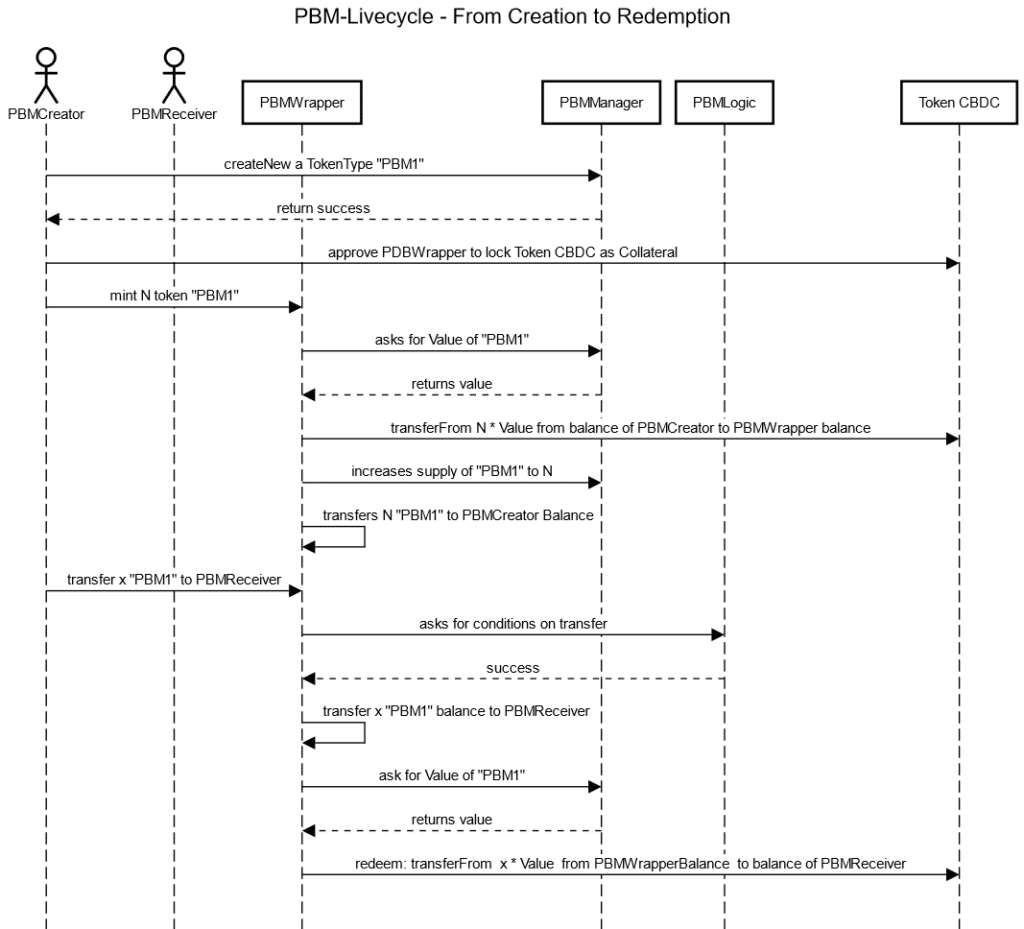

The composable nature of the PBM design means that it is possible for a smart contract called “PBM Wrapper” to be developed by a private sector entity, which may want to operate directly on (e.g. CBDC) token based money but want to restrict its usage based on its own proprietary programmable rules. PBM is designed to be technology-neutral, compatible with different ledgers.

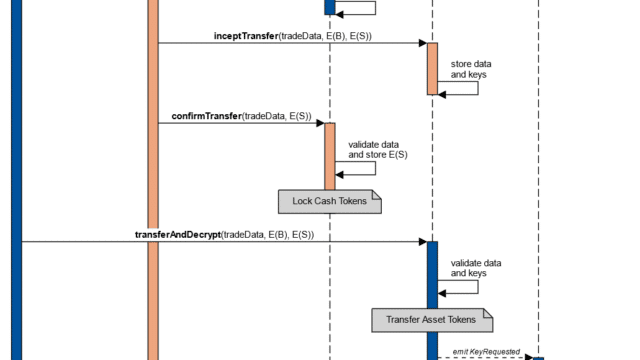

Digital money ownership can be transferred to a special “PBM Wrapper” Contract, which governs its usage based on specified conditions. Implementation may utilize the ERC-1155 standard or equivalent. The PBM holder can redeem tokens after fulfilling conditions, and during the redeem stage, the underlying digital money is transferred. The paper presents some comprehensive sequence diagrams that illustrate the creation of PBM tokens, the process of locking underlying money tokens and ultimately, the conversion back to the original digital money units once their intended purpose is achieved. The following diagram provides a compact view on a possible live cycle where PBM Transfer is conducted whereby associated conditions are met.

Concluding Remarks

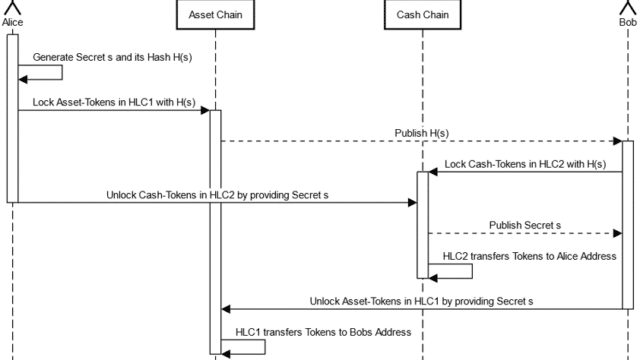

PBM’s potential uses include mitigating the risk of non-delivery for consumers paying upfront for goods and services. Another use case might be the application of complicance checks with regard to cross border payments. It can also approach the problem regarding „Delivery versus Payment“ in financial markets. It ensures corporations fulfil their obligations before receiving funds, providing assurance to both merchants and consumers. PBM could facilitate secure cross-border trade by offering rule-based features, aligning with the international roadmap for enhanced cross-border payments. One could also think further on specific financial PBM tokens such as a Foward Token enabling the owner to receive a certain entity (i.e. a stock) upon a future time point. Depending on the context this would require that the value of the token needs to get determined according to non-arbitrage based valuation models which might be provided off-chain.

Disclaimer: The opinions and statements expressed in this article are those of the author and do not necessarily represent the views of the company or organization.

Diese Themen interessieren uns

Learnings from ECB Exploratory Phase – Part 2: Review of the HTLC Mechanism

Learnings from ECB Exploratory Phase – Part 1